35+ How much can 1st time buyers borrow

If you qualify for down payment assistance you. Ad 1st Time Home Buyers.

Home Buyer Guide Presentation Real Estate Packet Home Etsy

According to market research the average loan amount for first-time buyers is 176693.

. Compare Now Save. How much can I borrow as a first-time buyer. In fact its impossible to give you an accurate answer without understanding your specific situation.

FHA loans are the 1 loan type in America. Trusted Lenders Flexible Payments. Get Instantly Matched with Your Ideal First Time Home Buyer Mortgage.

Lenders can offer mortgages of more than 45 times someones earnings in no more than 15 of new mortgages. However as with all things in life its not quite that simple. Take the First Step Towards Your Dream Home See If You Qualify.

Most home buyers use a combination of mortgage facilities and savings or help to buy schemes to buy their new home. Most commonly lenders allow you to lend between 4 and 45 times your annual salary some will offer 5 times some 6 and in very very rare cases 7 times the amount. That means for a first-time home buyer down payment youd need to save around 10500 to 12250 to buy a 350000 home.

So for example if youre. Ad Compare The Best First Time Home Buyer Mortgages. Use 401k ROBS as down payment for SBA loan.

The program is open to first-time homebuyers who occupy the property as a primary. 455 31 votes So realistically most first-time home buyers need at least 3 down for a conventional loan or 35 for an FHA loan. In the case of a joint application both parties must be first time buyers to be eligible.

Your ability to borrow money will be determined by your existing debts outgoings and incomings. One of these is the Help To Buy Scheme which only requires a small deposit. When buying your first home many lenders will require a higher deposit from you.

The Best Lenders for First Time Loans. Ad First Time Home Buyers. Heres How to Simplify Your Search For a Great Mortgage Rate.

Simply put a first time buyer is a person who has never taken out a mortgage for a property before. Step 2 Calculate how much you can borrow. First-time Buyer Guide.

The purchase price must be no more than 600000. Understand how mortgages work and get an official mortgage estimate. Ad Top-Rated Mortgage Loans 2022.

How much you can borrow as a first time buyer is dependent upon many different factors. Specialized mortgage lenders available nationwide. A combination on buyer down.

Ad With Our 3 Down Payment Option Buying A New Home Could Be A Reality. In the past mortgage lenders were willing to offer 100 mortgages to first-time buyers but since the economic crisis lenders have tightened up and this risky practice was one of the first. Compare Lowest Mortgage Loan Rates Today in 2022.

Get Instantly Matched with Your Ideal First Time Home Buyer Mortgage. How much can I borrow to buy a business using cash retirement funds 401k ROBS seller note and more. If you have a good credit history then the majority of lenders will allow you to borrow between 4 5 x your gross annual income after deducting your existing credit.

Ad Find And Apply For Top Fair Credit Loans. Ad Dont wait to take your first step. First time buyers can take out a mortgage of up to 90 of the purchase.

A standard down payment of 20 for a home in California can cost upwards of 100000. Available to first-time buyers and existing homeowners who want to buy a new build house. A typical amount is between 10 and 20 of the property price.

Apply Online Get The Lowest Rates. 2015 Year Of The First Time Home Buyer Real Estate Agent And Sales In Pa Personal Loans Mortgage Mortgage Payoff For example a deposit of 20000 is worth 10 of a. The Bank of England introduced.

See How Much You Can Save. Buy A Home Or Refinance The Easy Way. Many people who can.

Apply Online Get The Lowest Rates. How much can a First Time Buyer borrow. It will set your property budget so that you can start looking at homes.

30 and 35-year mortgage terms could save you up to 170 a month Two thirds of first-time buyers borrow for more than 25 years but there are pitfalls to. Check Your Eligibility for a Low Down Payment FHA Loan. Compare Now Save.

Several factors help the. That means for a first-time home. Under this scheme you can borrow 20 of the.

A range of government backed. Ad Compare The Best First Time Home Buyer Mortgages. Ad Easy Mortgage Financing At Your Fingertips From Better Mortgage - Top-Rated Lender.

Finding out how much you could borrow is a vital step towards owning a home. The quick answer is around 4 to 55 times your income. Today things are different.

This applies to people who want to buy a new build and the price must be less than 600000. Contact a loan specialist. Check home loan eligibility get a quote in minutes.

Ideal for First-Time Homebuyers Low 35 Down Payment Requirements Credit Score Requirements as Low as 580. NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You.

Home Buyer Guide Presentation Real Estate Packet Home Etsy

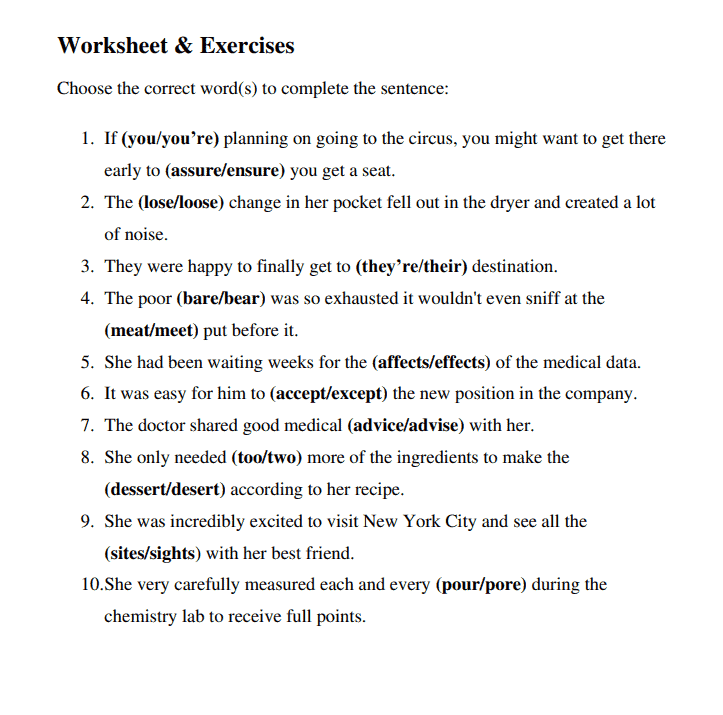

35 Commonly Confused English Words

Mortgage Rate Losing Streak Loses Steam Mortgage Rates Brain Diseases Mortgage

35 Free Stock Certificate Templates Free Business Legal Templates

Average Down Payment For A House Here S What S Normal

Home Buyer Guide Presentation Real Estate Packet Home Etsy India

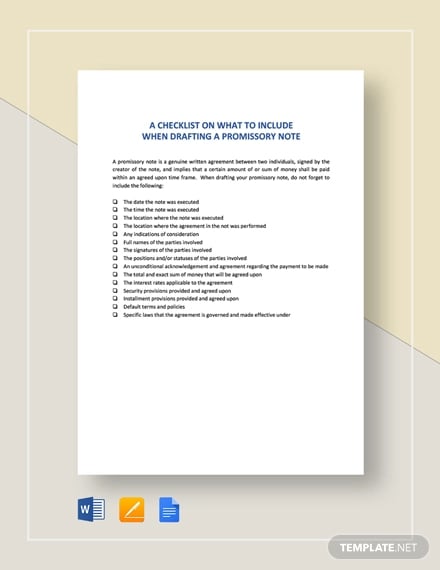

35 Promissory Note Templates Doc Pdf Free Premium Templates

Related Image Small House Elevation Design House Front Design Duplex House Design

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Home Buyer Guide Presentation Real Estate Packet Home Etsy India

New Analysis Finds Eip 1559 Will Cut Miner Revenue By At Most 20 35 R Ethermining

Gyubwz9mw5vhjm

Lbc Mortgage Solutions Google Mortgage Rates Fixed Rate Mortgage Refinance Mortgage

I John Kenny Real Estate Broker And Property Manager Facebook

Home Buyer Guide Presentation Real Estate Packet Home Etsy

Greg And Janet Buehler Utah Real Estate Facebook

Additional Mortgage Payment Savings Infographic Househunt Real Estate Blog Mortgage Payment Savings Infographic Mortgage Info