47+ where to enter mortgage interest on tax return

Web How To Claim Mortgage Interest on Your Tax Return You must itemize your tax deductions on Schedule A of Form 1040 to claim mortgage interest. Web If you have Mortgage Interest for your rental home you would enter the Mortgage Interest as an expense on your Schedule E.

Mortgage Broker Home Loans Richmond Hawthorn Kew Mortgage Choice

Additionally for tax years prior to 2018 the.

. Web Homeowners who bought houses before December 16 2017 can deduct interest on the first 1 million of the mortgage. Ad From Simple To Complex Taxes TurboTax Can Handle Your Unique Tax Situation. File your taxes stress-free online with TaxAct.

Web For you to take a home mortgage interest deduction your debt must be secured by a qualified home. Web Up to 96 cash back Who qualifies for the mortgage interest tax deduction. TurboTax Will Get Your Maximum Refund Guaranteed Or Your Money Back.

6 Often Overlooked Tax Breaks You Dont Want to Miss. Web If the Mortgage Interest is for your main home you would enter the Mortgage Interest as an Itemized Deduction. Web In order for your mortgage payments to be eligible for the interest deduction the loan must be secured by your home and the proceeds of the loan must have been.

Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an individual. Beginning in 2018 the limitation for the amount of home. Ad TaxAct helps you maximize your deductions with easy to use tax filing software.

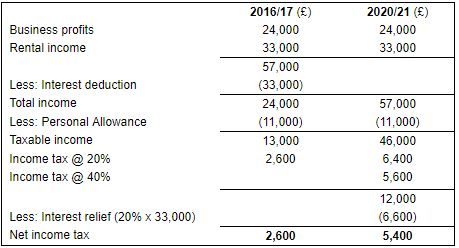

Filing your taxes just became easier. Web Mortgages that existed as of December 15 2017 will continue to receive the same tax treatment as under the old rules. Web If you are charging 10000 in rent for your property and are being charged 9000 in mortgage interest then you will be taxed on the full 10000 income.

To do this sign into TurboTax and click Deductions Credits Search for PMI search button on top right of screen and click the Jump to. Web Open your return. This means your main home or your second home.

TurboTax Will Get Your Maximum Refund Guaranteed Or Your Money Back. Learn More at AARP. Claiming the mortgage interest deduction requires.

If you itemize deductions on Schedule A you can deduct qualified mortgage interest paid on a qualifying. A home includes a. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

The entry would be made by following these steps. Ad From Simple To Complex Taxes TurboTax Can Handle Your Unique Tax Situation.

Mortgage Interest Relief Restriction Mercer Hole

Loan Against Property Apply For Mortgage Loan Online Indusind Bank

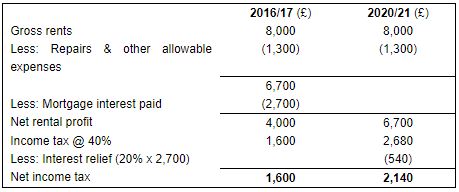

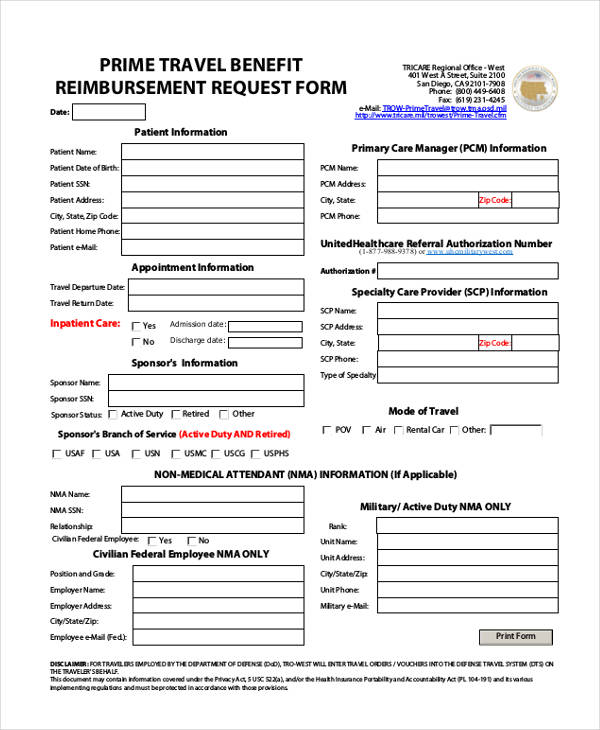

Free 47 Sample Travel Request Forms In Pdf Ms Word Excel

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

𖣠 Home Mortgage Interest Deduction 𖣠 Tax Form 1098 𖣠 Youtube

How Will Inflation Impact Retirees And Those Approaching Retirement Age Quora

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Calculating The Home Mortgage Interest Deduction Hmid

Where Do I Report Mortgage Interest On A 1040 Form

5 Things You Did Not Know About Personal Loan Axis Bank

Free 47 Sample Travel Request Forms In Pdf Ms Word Excel

Loan Against Property Apply For Mortgage Loan Online Indusind Bank

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Interest Statement Form 1098 What Is It Do You Need It

Form 1098 Mortgage Interest Statement Community Tax

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

S Corporation Returns 2001 Document Gale Academic Onefile